What Is a Surety Bond and Who Needs One?

The purpose is simple, a surety bond is a financial guarantee that you will follow the rules of a license, permit, or contract.

This post explains what a surety bond is, how it works, and who needs one, with real examples tied to

official government requirements (including DMV-related bonds and other common license and permit bonds).

What is a surety bond?

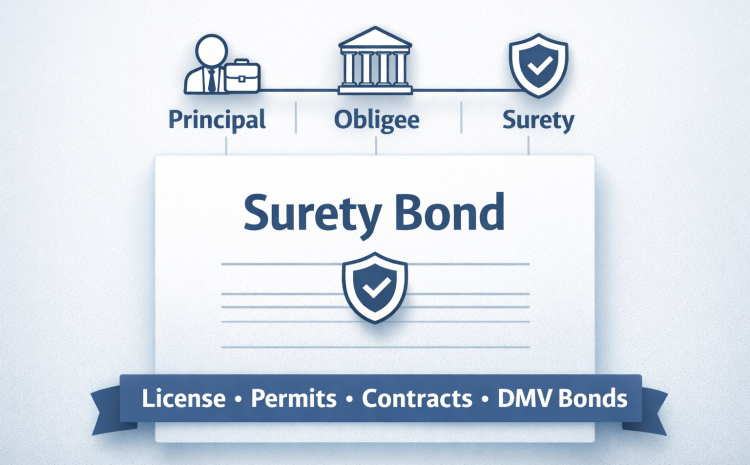

A surety bond is a three-party agreement that guarantees performance, compliance, or payment.

In plain English, it’s a promise backed by a surety company that you will:

- follow the laws and rules tied to your license or permit,

- perform a contract as agreed (especially in construction and government contracting), and/or

- pay certain obligations (for example, paying subcontractors and suppliers on a bonded project).

Many public and private contracts require surety bonds. The U.S. Small Business Administration (SBA) describes surety bonds as a tool that

helps guarantee a contract will be completed, and notes that bonds are often required on contracts. [1]

The three parties in a surety bond

Surety bonds always involve three roles:

- Principal – the person or business that must obtain the bond (for example, a motor vehicle dealer, contractor, or freight broker).

- Obligee – the government agency or private party requiring the bond (for example, a DMV, licensing board, or project owner).

- Surety – the surety company issuing the bond and providing the financial guarantee.

When you buy a surety bond, you are not “buying protection for yourself.” You are providing protection to the obligee and the public

if you fail to meet your legal or contractual obligations.

Surety bond vs insurance

This is one of the biggest points of confusion for people searching online for surety bond insurance.

Here’s the clean distinction:

- Insurance transfers risk from the insured to the insurance company (the insurer expects losses and prices accordingly).

- Surety is a credit-backed guarantee, if the surety pays a valid claim, the principal is generally expected to reimburse the surety.

That reimbursement expectation is why bonding decisions focus heavily on financial strength, history, and the ability to perform.

It’s also why “bonded and insured” usually means two different protections are in place.

Who needs a surety bond?

You typically need a surety bond when:

- a government agency requires it as part of a license or permit,

- a contract owner requires it to award you a job (common in construction), or

- a law or regulation requires financial security to protect consumers and other businesses.

For example, some state DMVs and occupational licensing divisions require surety bonds to be maintained continuously for certain license types.

California’s DMV explains that many occupational license types require a valid surety bond and warns that failing to maintain continuous coverage can lead to cancellation.

[2]

Common surety bond types (with real examples)

1) DMV and auto dealer bonds

An auto dealer bond (often called a DMV bond) is typically required to obtain or maintain a dealer license.

While requirements vary by state and dealer type, the intent is generally to protect consumers and ensure dealers follow applicable laws.

California example: California DMV occupational licensing forms list common bond amounts tied to Vehicle Code licensing categories.

One DMV-published form shows a $50,000 bond amount for a “Dealer” and also lists lower bond amounts for certain categories like motorcycle/ATV dealers and some wholesale-only dealers.

[3]

Texas example: The Texas Department of Motor Vehicles publishes a “Motor Vehicle Dealer’s Surety Bond” form showing a penal sum of

$50,000 and cites the Transportation Code section requiring a bond with the dealer license application.

[4]

If you’re applying for a dealer license, don’t guess. Use your state DMV’s official licensing instructions and forms to confirm the exact bond amount,

the correct obligee name, and how the bond must be filed (paper vs electronic submission).

2) Ownership (title) surety bonds

A different DMV-related bond is an ownership (title) surety bond. This is commonly used when the required evidence of ownership is missing,

and the DMV requires a bond to help protect prior owners or lienholders.

California example: California DMV describes when a “Motor Vehicle Ownership Surety Bond” is required, including scenarios where supporting evidence of ownership is not available,

and outlines how the bond amount ties to the vehicle’s fair market value.

[5]

3) Contractor license bonds and construction bonds

Construction uses surety in two common ways:

- License bonds required by a contractor licensing board to get or maintain a license.

- Contract bonds required by a project owner, such as bid bonds, performance bonds, and payment bonds.

In government contracting, bonds are often mandatory, and the SBA operates a program to help qualified small businesses access bonding

by guaranteeing certain surety bonds.

[1]

4) Freight broker bonds (BMC-84)

If you’re becoming a property freight broker, federal rules require proof of financial responsibility.

The Federal Motor Carrier Safety Administration (FMCSA) states that brokers of property must show financial security via a surety bond (Form BMC-84)

or a trust fund agreement (Form BMC-85) in the amount of $75,000.

[6]

5) Notary, court, and other license and permit bonds

Depending on your industry and state, you may run into:

- Notary bonds (often required to commission as a notary public in many states),

- court bonds (appeal bonds, probate bonds, fiduciary bonds),

- tax bonds (fuel tax, alcohol tax, and other regulatory bonds),

- miscellaneous license bonds tied to specific regulated occupations.

The common thread is that the bond exists because a regulator or court wants a financial backstop to protect the public or an injured party.

How much does a surety bond cost?

The bond amount (also called the penal sum) is not the same as the bond premium (what you pay).

Your premium is usually a small percentage of the bond amount, and it depends on:

- bond type and bond amount,

- your credit and financial profile,

- industry experience (especially for contract bonds),

- claims history,

- business financial statements (for larger bonds).

For larger contract bonds, sureties often underwrite like a lender, because the principal is typically responsible for reimbursing the surety if a valid claim is paid.

For smaller license bonds, underwriting may be lighter, but the same concept applies.

What happens if a claim is filed?

A bond claim usually follows this pattern:

- A problem occurs (for example, legal noncompliance, failure to pay, failure to perform).

- A claimant files a claim with the surety under the bond.

- The surety investigates to determine whether the claim is valid under the bond’s terms and applicable law.

- If valid, the surety pays up to the bond amount (or takes steps to remedy performance, depending on bond type).

- The principal reimburses the surety for amounts paid (common for most surety arrangements).

This is why bonding is not “free money” protection for the principal. A bond is meant to protect the obligee and the public,

while holding the principal financially accountable.

How to get a surety bond (step-by-step)

- Find the official requirement. Start with your licensing agency or regulator’s instructions and forms.

For example, California DMV provides guidance for occupational licensees on how to submit surety bonds and stresses continuous coverage.

[2] - Confirm the bond details. You need the correct bond amount, obligee name, and any required bond form language.

(Many agencies publish an approved form, like Texas DMV does for dealer bonds.)

[4] - Apply with a surety provider. For simple license bonds, you may only need basic business and owner information.

For larger contract bonds, be prepared to provide financial statements and work history. - File it the right way. Some agencies accept electronic filing, others require original signatures, seals, or powers of attorney.

- Maintain continuous coverage. Many licenses require that the bond remain active at all times.

A lapse can cause delays, suspension, or cancellation.

[2]

Quick FAQ

Is a surety bond the same as business insurance?

No. Insurance is designed to cover the insured’s losses, surety is designed to protect the obligee/public and generally requires reimbursement by the principal if the surety pays.

How fast can I get a surety bond?

Many license and permit bonds can be issued quickly once the application is complete. Larger contract bonds can take longer due to underwriting.

What if I’m denied bonding?

For certain contract bonds, small businesses may qualify for support through the SBA’s Surety Bond Guarantee program, which helps increase access to bonding for eligible businesses.

[1]

Do bond requirements vary by state?

Yes, significantly. Always verify your exact requirement using your regulator’s official site, statutes, and approved bond forms.